Please note: Due to the impact of Covid-19 we are currently experiencing increased processing times from our banking partners.

Introductory Video:

Click the video appropriate for you

Financial Adviser

[mailchimp_rates_signup /]This is for financial advisers that access the Term Deposit Shop cash management platform on behalf of their clients.

2 min videoDirect Client

This is for clients that access the Term Deposit Shop cash management platform on their own behalf .

2 min videoWhat We Do

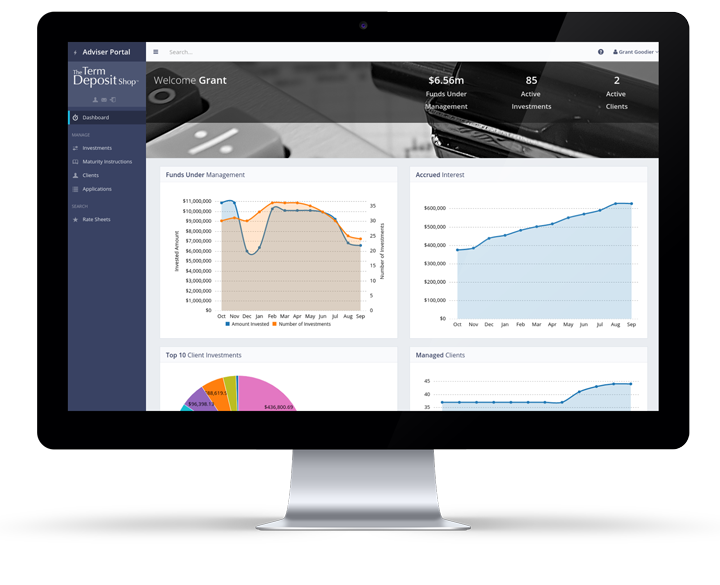

The Term Deposit Shop is a fully transactional Online Cash Management Platform that makes it easy to move from one bank to another in order to maximise return with minimum effort.

Users of the platform are able to take a far more proactive approach to managing cash investments that delivers enhanced returns and liquidity compared to the old set and forget way of doing things.

Our underlying philosophy is that the outcome for clients be the same as if they were dealing with the bank themselves but TTDS is handling all the administration to facilitate transactions.

And it’s not just for term deposits. Also take advantage of at-call bonus rates and notice accounts to further enhance returns and liquidity.

Monthly or quarterly interest payment frequencies are also available if you want regular income payments.

Register Today

Why We Do It

For anyone who has tried moving to another bank to take advantage of a better rate, you know how cumbersome the process is.

You have to:

- Research the market to find out who has the best rate

- Fill out all the paperwork to open a new account

- Provide the bank with documents to prove your identity

- And Transfer the funds

Then, at maturity you have to repeat the whole process again.

Given the time and effort required many investors simply elect to automatically re-invest their funds for the same term, with the same bank, that often results in them being disadvantaged with a not-so competitive rate.

Register TodayHow We Do It

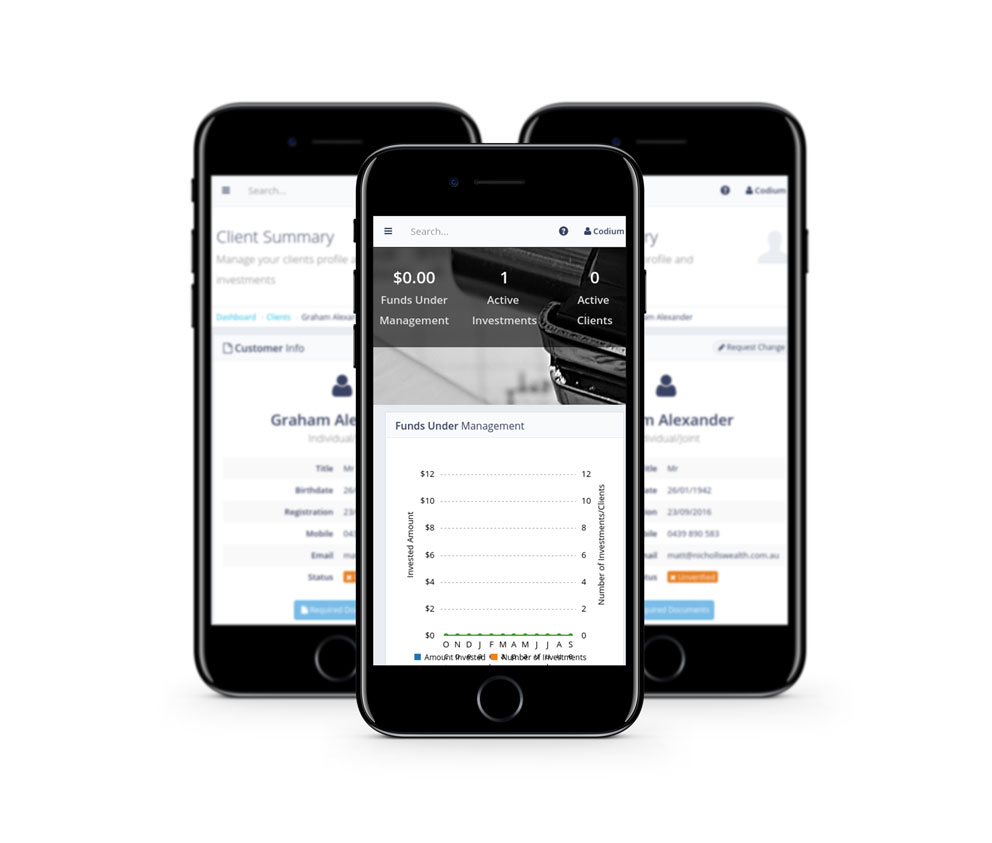

Clients authorise us to manage the investment process on their behalf. After that, they’re able to access rates from a broad range of banks, building societies and credit unions all in one place and transact online, anywhere, anytime at the click of a button on any device.

At maturity they can move from one bank to another with no further paperwork. We handle all the administration to facilitate transactions. All banks, building societies and credit unions we deal with are covered by the government guarantee.

Our services are available to clients with $10,000 or more to invest and all types of legal entities, such as individuals, companies and self-managed super funds. Clients can access the online platform themselves directly or via their financial adviser.

Register Today

Weekly Rates Sheet

Ensure you are up to date, enter your email address below to recieve our rates sheet delivered to your inbox!